In This Issue:

-

How To Get Pre-Approved And Know What You Can Afford Without Hurting Your Credit - Secure your buying power with a lender-ready plan, avoid common credit mistakes, and shop with confidence.

Read More » -

Pricing Your Home Right From Day One Why Overpricing Backfires - Learn why the first price is the most important, and how to attract serious buyers without leaving money on the table.

Read More » -

Contingencies Decoded What They Mean For Your Deal - Understand the conditions that protect both sides, and how to negotiate them without derailing the transaction.

Read More »

How To Get Pre-Approved And Know What You Can Afford Without Hurting Your Credit

Summary

Pre-approval is one of the strongest advantages a buyer can have, but the steps you take during the process can help or hurt your credit. This report explains how lenders evaluate you, what to prepare before you apply, and how to protect your score while you comparison-shop. You will also learn how to set a realistic budget that includes more than just the mortgage payment. Use this guide to get fully ready to make an offer quickly and confidently.

Pre-approval is not just a box to check. It is a practical roadmap that tells you what a lender is willing to support, what your monthly payment range could look like, and how strong your offer will appear to a seller.

Here is how to get pre-approved the right way, and how to protect your credit while you do it.

1. Know What Pre-Approval Actually Means

1. Know What Pre-Approval Actually Means

A true pre-approval is based on a lender review of your income, debts, credit, and down payment. It is different from a quick online estimate. Sellers and listing agents treat a real pre-approval as proof that you are ready to proceed.

2. Gather the Right Documents Before You Apply- Recent pay stubs and proof of income

- Two years of tax documents (as applicable)

- Bank statements showing down payment funds

- Current debt information (loans, credit cards, lines of credit)

Ask your lender about rate-shopping windows. In many cases, multiple mortgage inquiries within a short period are treated as one inquiry for scoring purposes. Still, avoid unnecessary new credit applications, and do not make big changes to balances right before applying.

4. Decide on a Comfortable Budget, Not Just a MaximumYour approved amount is not a recommendation. Build a budget that includes property taxes, utilities, insurance, and any condo or HOA fees. Leave room for maintenance and lifestyle needs so ownership stays comfortable after closing.

Conclusion:

A strong pre-approval improves your negotiating position and reduces stress once you find the right home. When you prepare properly and protect your credit, you can act quickly without overextending your budget.

Pricing Your Home Right From Day One Why Overpricing Backfires

Summary

Pricing your home correctly is one of the most important decisions you will make as a seller. Overpricing can reduce showings, cause your listing to go stale, and weaken your negotiating position. This report explains how buyers interpret price, how online search ranges affect exposure, and how to use local comparables to set a smart number. The goal is to create strong early momentum that leads to better offers.

The first weeks on the market are your best opportunity to attract motivated buyers. A price that is even slightly out of line can reduce showings and shift the conversation from value to discounts.

Use these principles to price strategically from day one.

1. Buyers Compare You to the Best Alternatives

1. Buyers Compare You to the Best Alternatives

Buyers shop online with filters. If your price sits above similar options, you may be skipped before anyone sees the home in person. Pricing to match the market ensures you appear in the right searches and shortlists.

2. The Market Responds FastA well-priced home often earns more showings quickly, which can lead to stronger offers. A slow start is a signal to buyers that you may be overpriced, even if nothing is actually wrong with the property.

3. Use Comparable Sales, Not Opinions- Focus on recent sold properties that are truly similar

- Adjust for differences such as renovations, lot size, and condition

- Review active listings to understand your competition today

A price that lands just under common search thresholds can increase visibility. Your agent can help you choose a number that fits buyer search habits without underselling the home.

Conclusion:

The right price attracts the right buyers. When you price accurately from the start, you create urgency, maintain leverage, and improve your chances of a smooth closing.

Contingencies Decoded What They Mean For Your Deal

Summary

Contingencies are the conditions in a contract that must be satisfied before a transaction can close. They can protect buyers and sellers, but they also create timelines and negotiation points that need to be managed. This report explains the most common contingencies, how they affect risk, and how to use them strategically. With clarity on terms and deadlines, you can reduce surprises and keep the deal moving.

A contingency is a contract condition that must be met for the agreement to move forward. Understanding contingencies helps buyers protect their downside and helps sellers evaluate how likely an offer is to close.

- Financing Contingency

Gives the buyer time to secure a mortgage. Sellers should confirm the quality of the pre-approval and the timeline for final approval.

- Inspection Contingency

Allows the buyer to investigate the home. The best outcomes come from clear communication and focusing on meaningful issues rather than cosmetic items.

- Appraisal Contingency

Protects the buyer if the home appraises below the offer price. Strong offers often plan for this possibility before it becomes a surprise.

- Title and Document Review

Ensures ownership and legal status are clear, and that key documents such as condo or HOA materials have been reviewed.

Conclusion:

Contingencies are not just fine print. They are the guardrails of the deal. When both sides understand the timelines and risks, transactions close with fewer last-minute issues.

San Diego homes hidden inventory

|

San Diego Housing: Buyers Gain $100,000 in Buying Power as Inventory Rises

|

San Diego Market Shift 2026: Buyers Gain Leverage Before Spring Inventory Spikes

|

Are You Living in Your Ideal Home… or Just the Familiar One?

|

San Diego Market Shift: Hot vs Cold Neighborhoods + Your ZIP Code Report

|

San Diego more homes, better deals, see this weekend?

|

What San Diego Housing Slowdown?

|

What Would Have to Happen for San Diego Prices to Crash?

|

Is Your San Diego Neighborhood Hot or Cold in 2026?

|

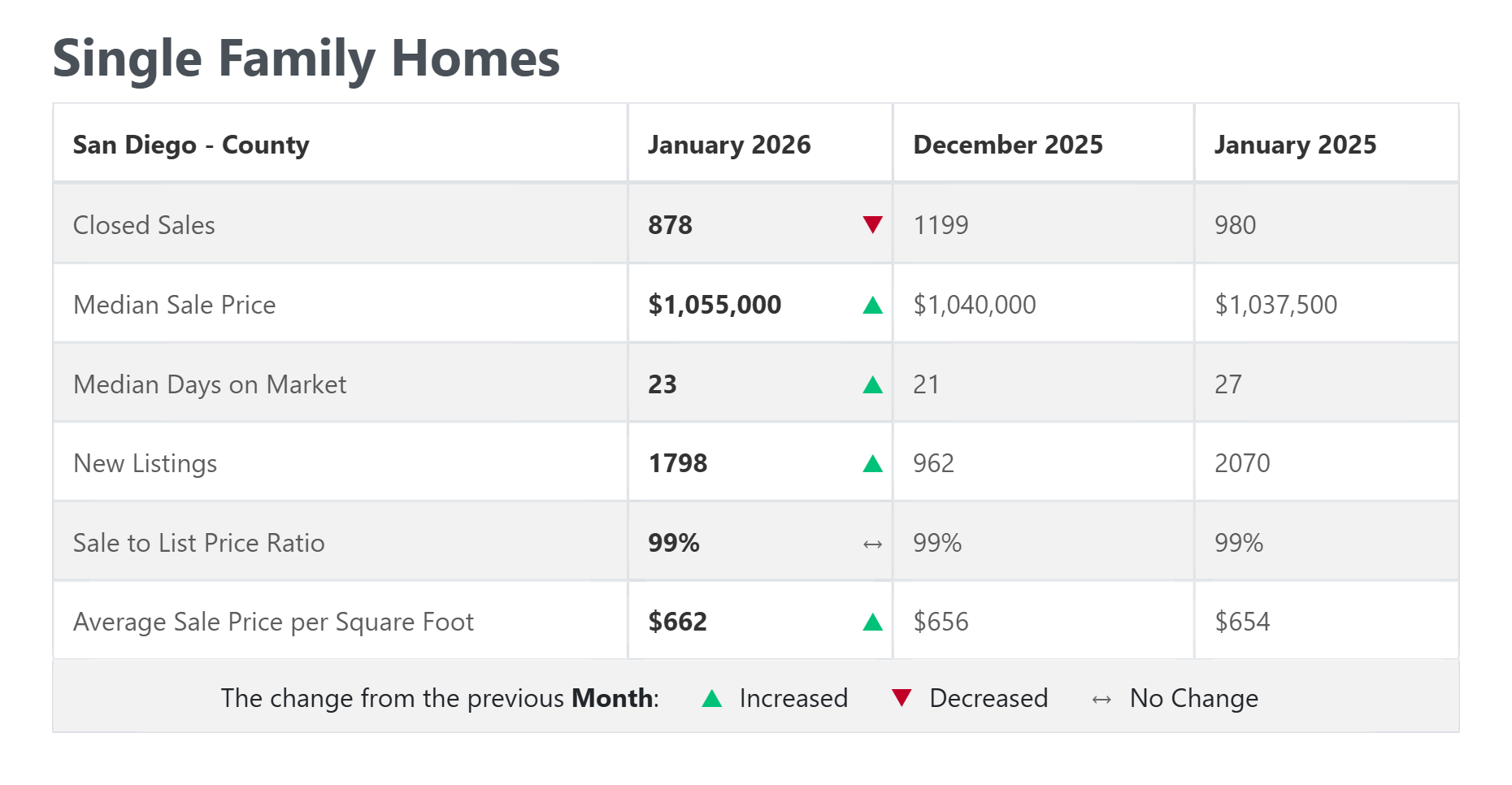

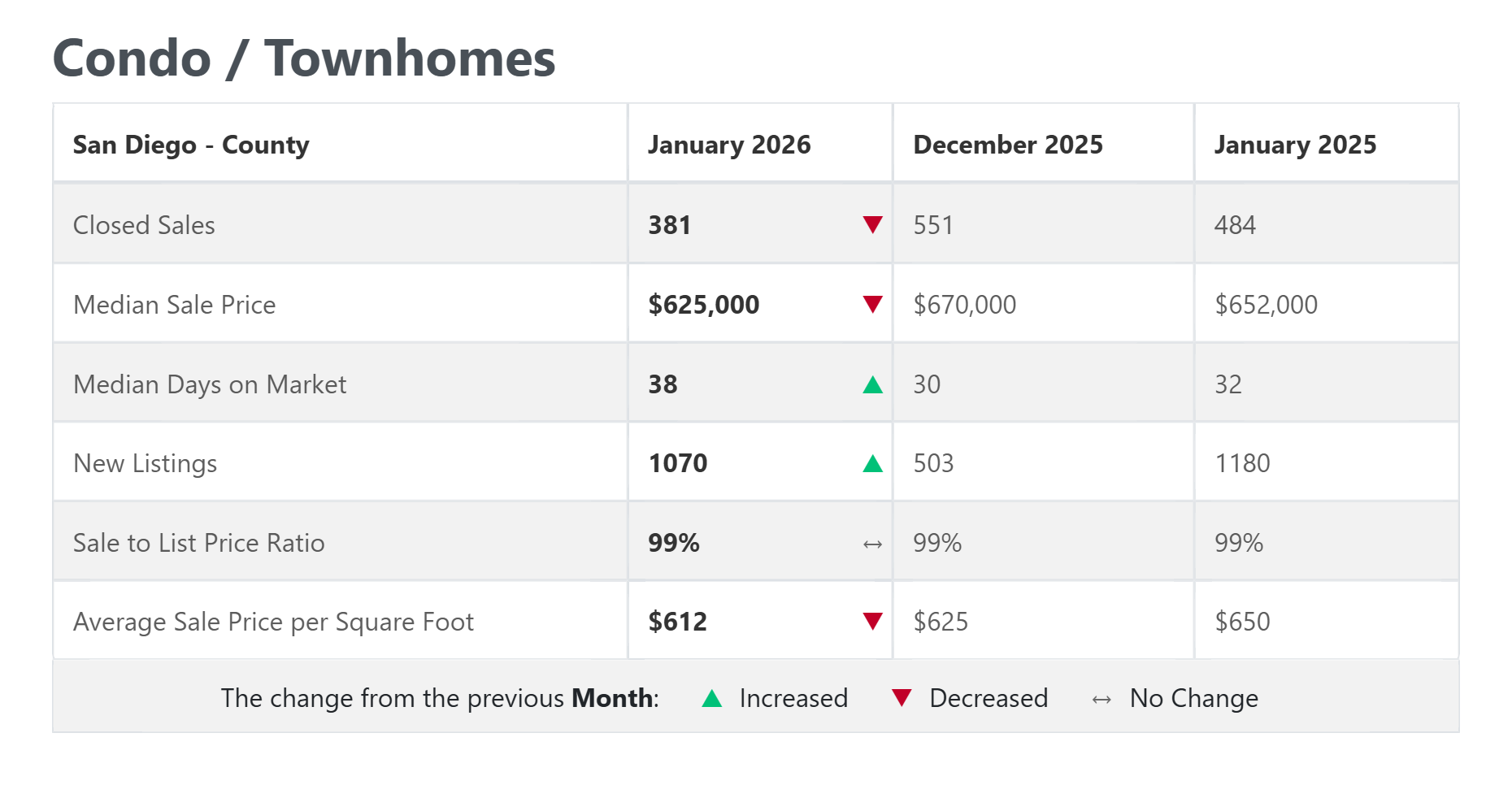

1,400 Homes Are Selling Every Month in San Diego — Is Yours One of Them?

|

San Diego Homes Are Moving Faster in 2026 (And Here’s Where Demand Is Hottest)

|

Spring Has Already Started in San Diego (Most People Miss This)

|

How do people afford San Diego homes

|

In 2026, Smart San Diegans Don’t Just Look at Prices — They Look at Timing & Options

|

San Diego Real Estate Opportunities Happening Now (Open House + 2–4 Unit Deals)

|

Why 1 in 3 San Diego homes do not sell and what to do about it. Expired listing.

|

San Diego Winter Market Is Here: Prepare for Launch (What Buyers & Sellers Should Do Now)

|

San Diego Housing Market Heating Up This January: Why Smart Buyers and Sellers Are Moving Now

|

Open House Downtown San Diego

|

San Diego Housing Market: Which Neighborhoods Are Hot — and Which Are Cooling in 2026

|

What 6% Rates Mean for Buyers & Sellers

|

2026 San Diego Housing What Buyers and Sellers are Doing

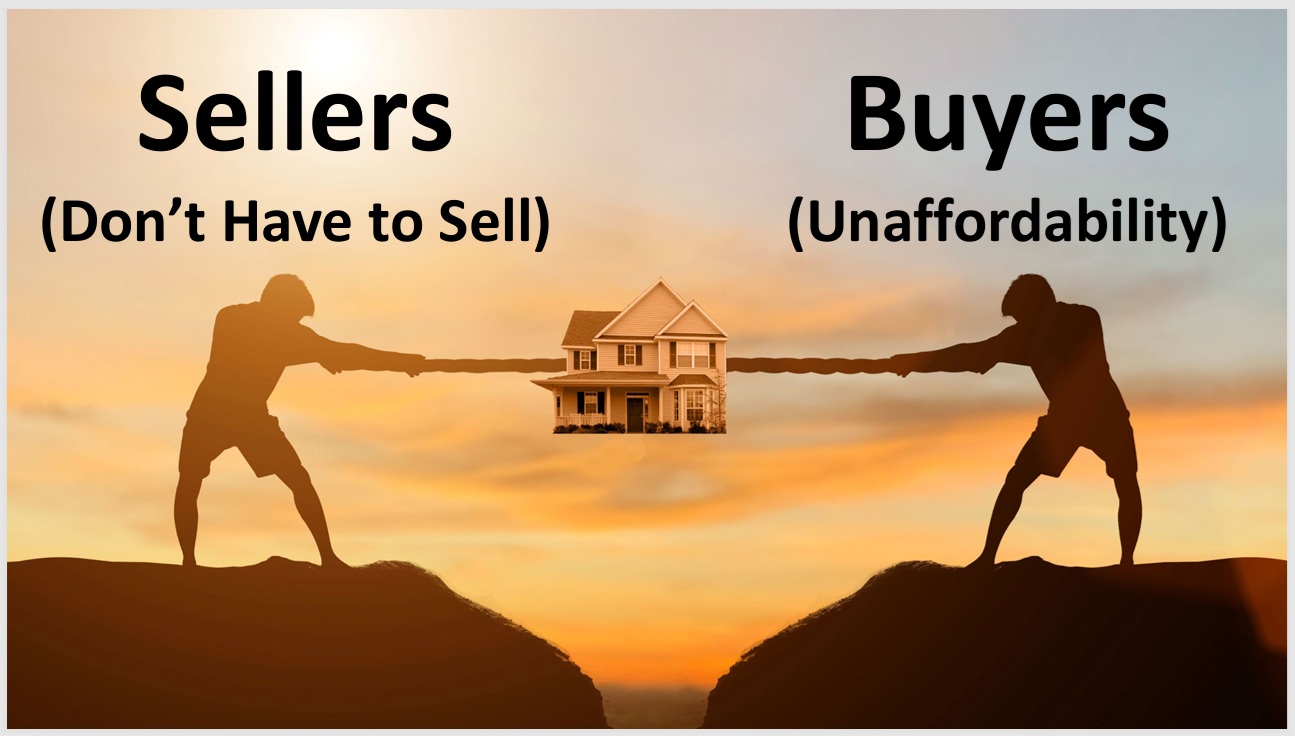

If buying or selling a home in San Diego is even on your radar in 2026, here’s the honest update I’m seeing every day — not the headlines. Buyers want lower mortgage rates, fewer bidding wars, and homes that actually feel like good deals. Sellers want to know if now is the window to sell before more inventory shows up. Here’s the truth: there is no perfect rate and no perfect year. The people who win are the ones who move with a plan — not hope. Online estimates miss what actually drives value in San Diego — condition, layout, upgrades, views, and micro-location. Homes on the same street can vary by hundreds of thousands of dollars. If you want real numbers — or a clear buy or sell plan for 2026 — call or text me directly at 619-846-1244. Helpful resources: P.S. The biggest mistake I’m seeing in 2026 is people waiting for “better conditions” that may never line up. If you want to see what’s actually available right now — including homes not on Zillow — start here before competition picks up.

|

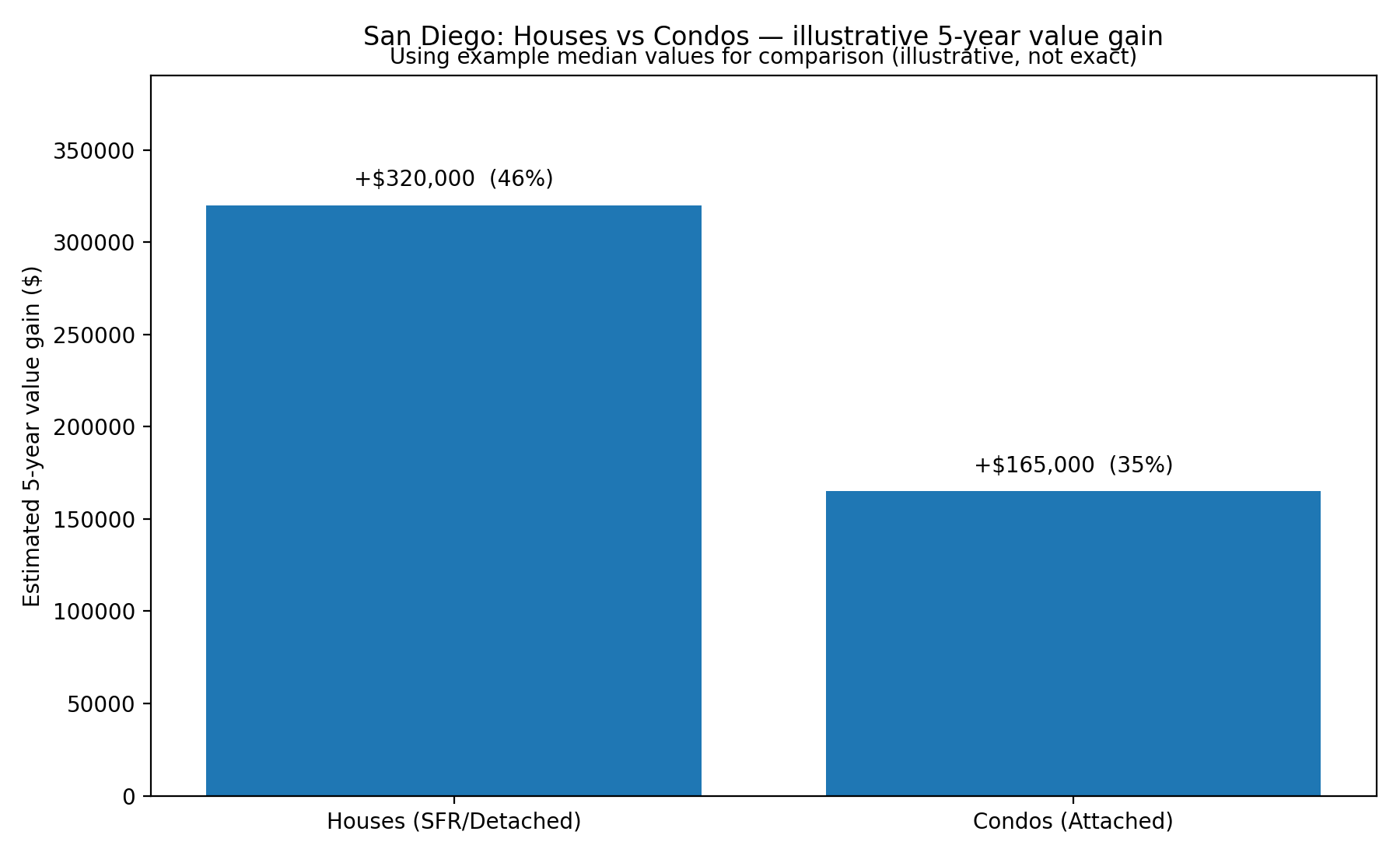

Houses vs. Condos in San Diego: Which Has Been the Better Investment (Last 5 Years)?

|

2026-san-diego-home-buyers-sellers-frustrated

Buyers want prices to come down. Sellers want prices to go up. Everyone wants mortgage rates under 6%. Sound familiar? Here’s the part that actually matters: mortgage rates are about 1% lower than last year, and that’s already changing what’s possible—especially for buyers under $1 million. Start here (most popular right now): See what’s available under $1M in San Diego This isn’t headlines or predictions—I’m seeing this daily in real contracts. Some buyers are getting options and leverage again, but only if they know where to look. If selling is even a possibility, the smartest first step is real numbers—not guesses from Zillow. You can see your true value and cash-offer options here: Value and Cash Offers. Waiting for “perfect” usually costs more than moving forward with a plan. If you want help sorting this out quickly, call or text me at 619-846-1244. I’ll give you straight answers and real options. George Lorimer Your Home Sold Guaranteed, or I’ll Buy It* *Conditions apply, ProWest Properties, DRE #01146839?

|

Surprising San Diego Home Trends I See in Person, Not on Zillow

|

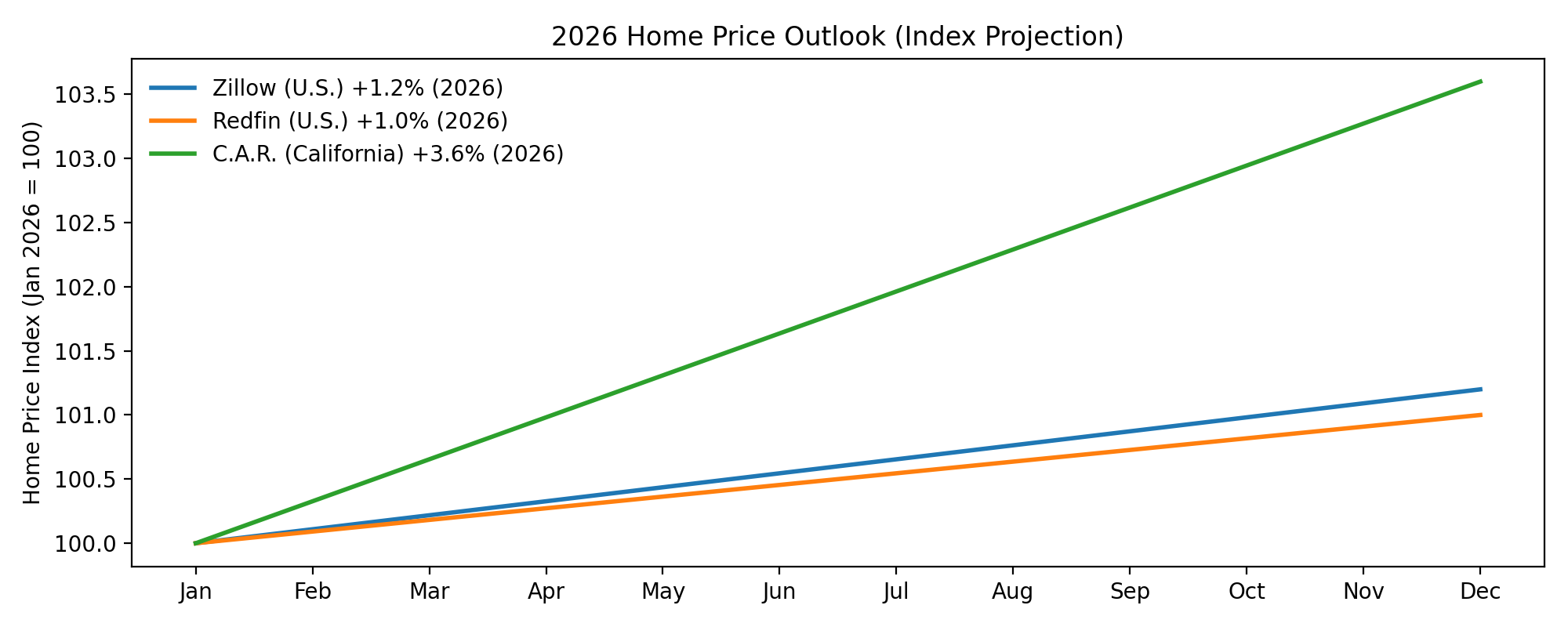

2026 San Diego Housing Outlook — What Buyers and Sellers Should Know Now

|

Rancho Peñasquitos & Torrey Highlands Homes 92129 Homes

Fast market snapshot (last 6 months as of Dec 19, 2025). If you want the full spreadsheet (every address + list/sold history), text “92129 DATA” to 619-846-1244. Most Torrey Highlands & newer RP sellers focus here (last 6 months). Want model-by-model detail? Text “92129 DATA” to 619-846-1244. Rancho Peñasquitos overall — sold last 6 months. Thinking of selling? Text your address & timeline to 619-846-1244. Source: SDMLS / ShowingTime ProWest Properties • DRE #01146839 • Your Home Sold Guaranteed or I’ll Buy It* • *Conditions apply I’ve lived and worked in San Diego for over 20 years, helping homeowners make smart decisions about when to sell, when to wait, and how to maximize value without pressure. Real estate is personal — that’s how I treat it. George Lorimer • ProWest Properties • DRE #01146839

|

San Diego home and short sales

|

San Diego’s Best “Quiet Window” to Plan a 2026 Move (Free 10-Minute Strategy Call)

|

How Long Does It Take to Sell a San Diego Home?

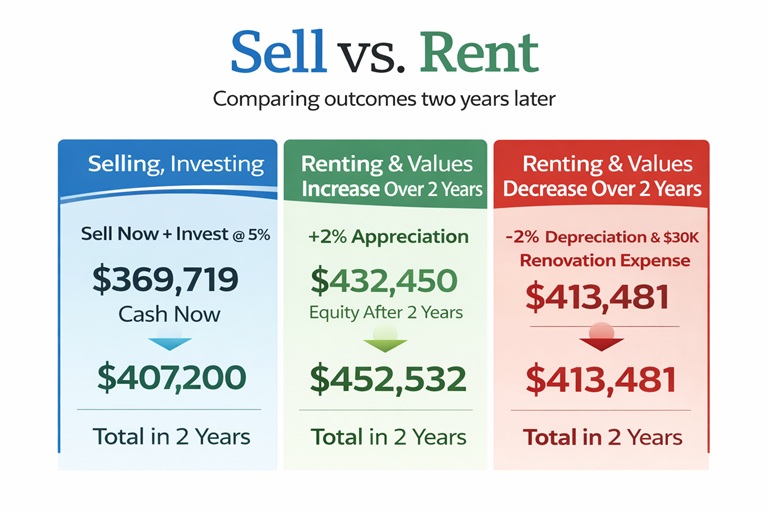

If you’re thinking about selling in 2026, here’s the truth: you don’t have to rush out after you sell. You can sell now and move later with a rent-back, or sell very fast if timing matters. Timeline example used below starts January 10, 2026. Your exact timing depends on pricing, condition, neighborhood, and strategy. You get paid first and move later — ideal if you’re finishing the school year or planning a summer move. Single-family homes typically sell faster than condos. Downtown and HOA-heavy condos often take longer, while well-priced houses in strong school districts move quicker. Want a clear plan for your timeline? George Lorimer • ProWest Properties • DRE #01146839

|

Buy a San Diego Home With an Under-6% Mortgage — Guaranteed

The Fed cut rates by 0.25% on December 10, 2025. Good news — but mortgage rates don’t drop automatically. They’re driven by the bond market. The smart move is learning how to secure the lowest rate available right now through negotiation. Call or text 619-846-1244 for a 10-minute strategy call. Want a free, customized report based on your price range and off-market homes? Call or text George at 619-846-1244. 30-year fixed rates are hovering in the low-6% range. FHA and VA can be lower. Sub-6% is achievable when offers are structured correctly. How do you guarantee an under-6% mortgage? I negotiate it with the seller as part of your offer. If they don’t accept it, my lender and I pay the loan discount so you still get the lower rate. Simple — just work with us on your purchase. George Lorimer • 619-846-1244 George Lorimer • ProWest Properties • DRE #01146839

|

San Diego 4-Step Plan to Buy or Sell a Home Without Stress

Most people don’t need more “advice.” They need a simple plan that reduces risk, prevents surprises, and gets them to the finish line. Here’s the exact 4-step process my team uses to help buyers and sellers move fast, stay protected, and avoid drama. Prefer a quick call? Call/Text George Lorimer at 619-846-1244 for a 10-minute strategy session. If the video doesn’t load, view it here: https://www.youtube.com/shorts/AuwjkgTXOxw?feature=share Buyers worry about overpaying or missing out. Sellers worry about pricing wrong, getting lowballed, dealing with repairs and showings, or buying the next home before the current one sells. The solution isn’t hope — it’s a clear process that removes risk. We start with clarity: updated home value, realistic net, buying power, neighborhoods, and what homes are actually available (including unlisted opportunities). This is where you stop spinning and start making smart moves. Most people only see one path: list it and hope, or buy and compete. We lay out multiple paths so you can choose what fits you: cash offer options, multiple investor offers competing, buy-before-you-sell solutions, and the right timing strategy for your goals. Once you choose the best path, my team handles the details: pricing, prep guidance, marketing, negotiation, inspections, and timelines — with one goal: get you the result you want with the least stress and the least wasted time. This is where most agents disappear — and where we do the opposite. We troubleshoot, protect your deal, and keep you informed. If plans change or something comes up, you’ve got an experienced team and real safeguards behind you. Bottom line: I have your back. If you’re thinking about buying or selling in the next 30–90 days, don’t wing it. Get the numbers and your best options first. George Lorimer • ProWest Properties • DRE #01146839

|

Meet George Lorimer San Diego broker and realtor

|

How to avoid the first mistake that San Diego home sellers makeIf you’ve been wondering what's going on in the San Diego housing market, here’s a quick reality check: The reason I tell you this is that there's an opportunity to buy at a good deal in this market. And if you're thinking of selling, don't price your home speculatively. For example, these speculative sellers say things like, "If I could get this price, I'd sell." (usually "their price" is higher than today's market value). For buyers, it becomes clear that the price may or may not have been based on today's statistics. For sellers, it's evident that unless you price it right, you may not sell. Here's my simple 3-step strategy that's helped over 1,000 sellers. 1) Determine that you are committed to selling. 2) Then price your home against competing listings, the homes buyers are comparing yours to. 3) Listen to feedback from the market and buyers and implement changes. Do this right, and you create urgency, competition, and the best chance of selling for top dollar. Call or text me, George, at 619-846-1244 to get your Complimentary Home Seller Report. All the best, George Lorimer Secret selling options that other agents don't offer.

|

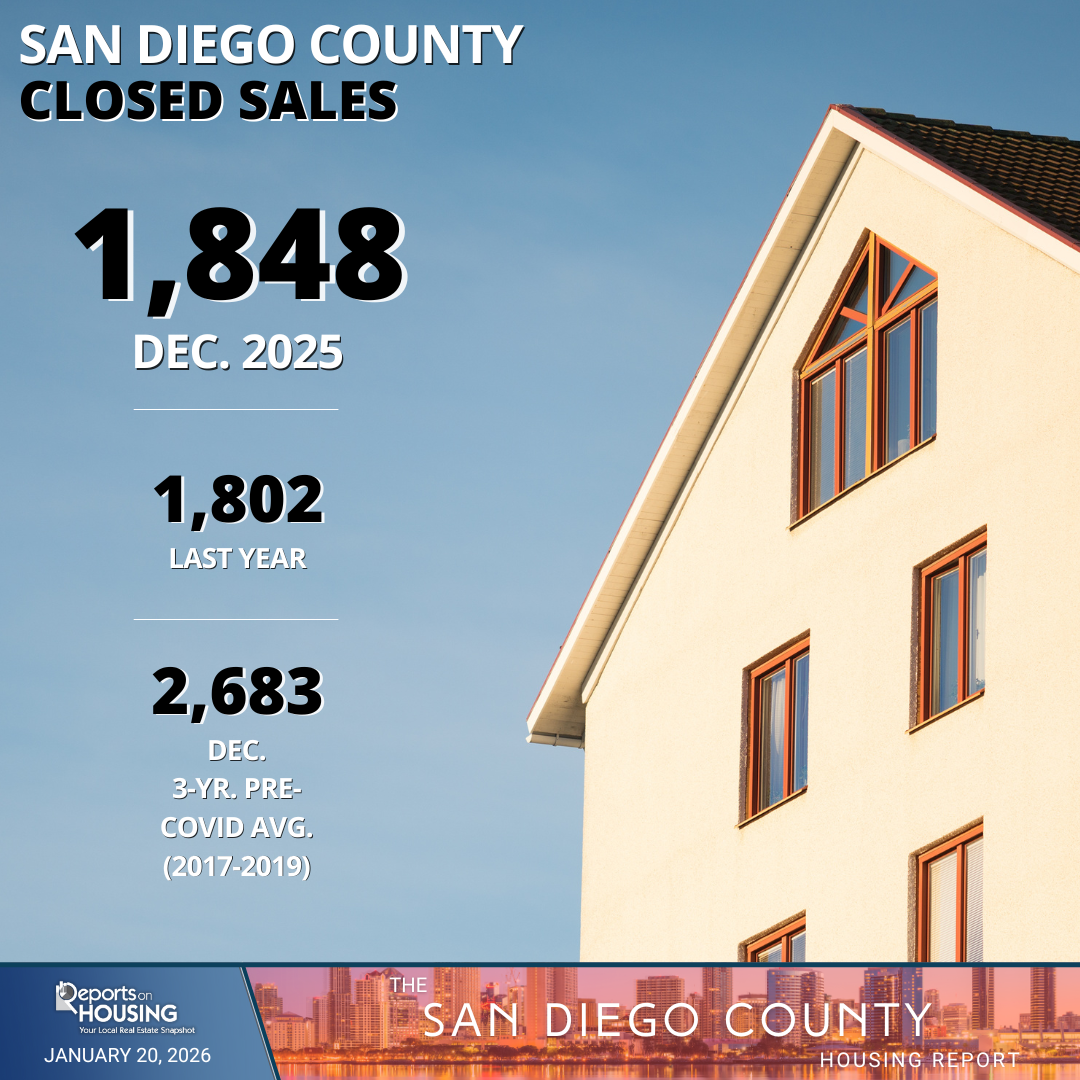

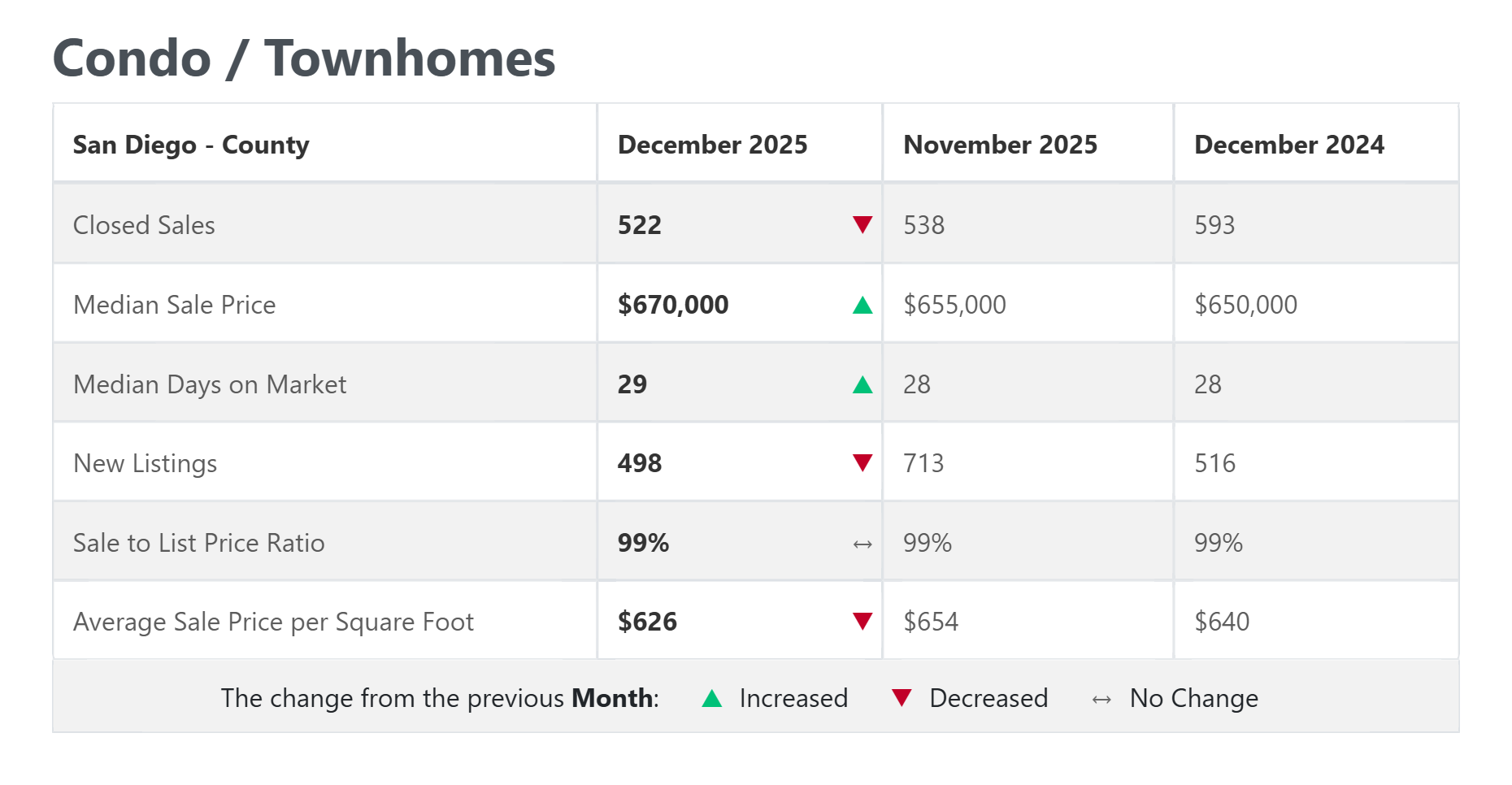

San Diego County Housing Report: Go for Gold, No Waiting

|